Identifying financial risk worksheet answers – Understanding how to identify financial risk is critical for businesses of all sizes. Our comprehensive worksheet provides a step-by-step approach to assess and mitigate potential risks, ensuring sound financial decision-making.

This guide will delve into the concept of financial risk, explore various types of risks, and provide real-world examples to illustrate their impact. We will also share best practices for effective risk management and provide a downloadable worksheet to help you navigate the process.

1. Identifying Financial Risks

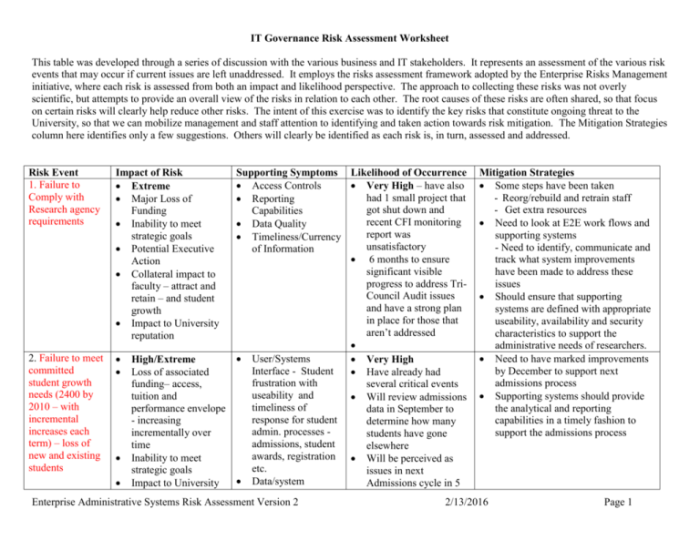

Financial risk refers to the potential for a company to experience financial losses due to various factors. These risks can arise from internal or external sources and can significantly impact a company’s financial performance and stability.

Types of Financial Risks

- Credit risk: The risk of loss due to the failure of a borrower to repay a loan or meet other financial obligations.

- Market risk: The risk of loss due to changes in market conditions, such as fluctuations in interest rates, currency exchange rates, or commodity prices.

- Operational risk: The risk of loss due to internal failures or disruptions, such as fraud, errors, or system failures.

- Liquidity risk: The risk of loss due to the inability to meet short-term financial obligations.

Examples of Financial Risk Impact, Identifying financial risk worksheet answers

- A company that relies heavily on a single supplier may face credit risk if the supplier goes bankrupt.

- A company that operates in a volatile industry may face market risk if demand for its products declines.

- A company that has poor internal controls may face operational risk if fraud is committed.

Top FAQs: Identifying Financial Risk Worksheet Answers

What are the common types of financial risks?

Common types of financial risks include credit risk, market risk, liquidity risk, operational risk, and compliance risk.

How can I use the financial risk assessment worksheet?

The worksheet provides a structured approach to identify, evaluate, and mitigate financial risks. It guides you through each step, ensuring a comprehensive assessment.

What are the benefits of effective financial risk management?

Effective risk management helps businesses make informed decisions, reduce uncertainty, improve financial performance, and protect against potential losses.