Fine print bond mutual fund fact sheet answer key – Fine print bond mutual fund fact sheets hold a wealth of crucial information for investors, yet deciphering their intricate details can be a daunting task. This guide unveils the key sections, considerations, and risks to empower investors with the knowledge to make informed investment decisions.

Delving into the fine print of bond mutual fund fact sheets, we will explore the essential factors to consider, including fees, investment objectives, risk profiles, and past performance. We will also shed light on the unique characteristics of bond funds, such as bond types, maturity dates, and yield payments.

Overview of Fine Print Bond Mutual Fund Fact Sheets

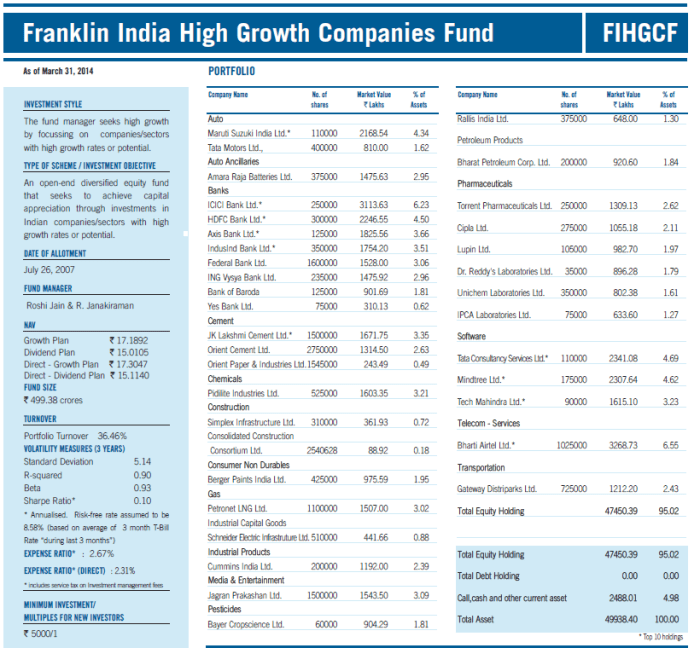

Fine print bond mutual fund fact sheets are comprehensive documents that provide essential information about bond funds. They help investors understand the fund’s objectives, risks, and performance.

These fact sheets typically include sections on investment objectives, strategies, fees and expenses, risk profile, performance data, and disclosures.

Key Considerations for Evaluating Fine Print: Fine Print Bond Mutual Fund Fact Sheet Answer Key

- Fees and expenses:Understand the various fees associated with the fund, including management fees, operating expenses, and sales charges.

- Investment objectives and strategies:Determine the fund’s primary investment goals and the strategies used to achieve them.

- Risk profile and volatility:Assess the fund’s level of risk, including its sensitivity to interest rate changes, credit risk, and market volatility.

- Past performance and returns:Review the fund’s historical performance and compare it to benchmarks and peer funds.

Understanding Bond Fund Characteristics

Bond funds invest in a portfolio of bonds, which have specific characteristics that influence their performance.

- Types of bonds:Bond funds can invest in various types of bonds, such as corporate bonds, government bonds, and high-yield bonds.

- Maturity dates and credit ratings:Bonds have maturity dates when they are repaid and credit ratings that assess their creditworthiness.

- Yield and interest payments:Bonds pay interest payments and have a yield, which represents the annual return on the investment.

Interpreting Performance Data

Fine print fact sheets provide performance data that helps investors evaluate the fund’s historical returns and risk.

- Historical returns and volatility:Review the fund’s annualized returns and standard deviation, which measures volatility.

- Sharpe ratio and other risk-adjusted measures:Assess the fund’s risk-adjusted performance using metrics like the Sharpe ratio.

- Comparison to benchmarks and peer funds:Compare the fund’s performance to relevant benchmarks and peer funds to gauge its relative standing.

Identifying Risks and Disclosures

Fine print fact sheets disclose important risks and legal information that investors should be aware of.

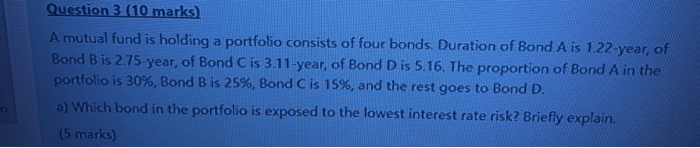

- Interest rate risk:Bond prices are sensitive to changes in interest rates, which can impact the fund’s value.

- Credit risk:Bonds carry credit risk, which is the possibility that the issuer may default on its obligations.

- Liquidity risk:Some bond funds may have limited liquidity, making it difficult to sell shares quickly at a fair price.

- Regulatory and legal disclosures:Fact sheets include important regulatory and legal disclosures, such as fund objectives, fees, and investment policies.

Using HTML Tables for Enhanced Presentation

HTML tables can be used to organize and present key information from fine print bond mutual fund fact sheets in a clear and concise manner.

| Category | Description |

|---|---|

| Fee Structure | Management fees, operating expenses, sales charges |

| Investment Objectives | Primary investment goals, strategies |

| Performance Metrics | Historical returns, Sharpe ratio, benchmark comparison |

| Risk Disclosures | Interest rate risk, credit risk, liquidity risk |

Common Queries

What are the key sections to look for in a fine print bond mutual fund fact sheet?

Key sections include fees and expenses, investment objectives and strategies, risk profile and volatility, past performance and returns, and bond fund characteristics.

How do I evaluate the risk profile of a bond mutual fund?

Consider the types of bonds held, maturity dates, credit ratings, and interest rate risk.

How can I interpret performance data in a fine print bond mutual fund fact sheet?

Analyze historical returns, volatility, Sharpe ratio, and comparisons to benchmarks and peer funds.