Chapter 12 payroll accounting working papers answers delve into the intricacies of payroll accounting, providing a comprehensive understanding of the significance, types, and analysis of working papers in payroll audits. This guide explores best practices for maintaining and organizing working papers, utilizing technology to enhance management, and discusses their crucial role in supporting audit findings.

Unveiling the complexities of payroll accounting working papers, this guide serves as an invaluable resource for accountants, auditors, and professionals seeking to master the intricacies of payroll accounting.

1. Introduction to Payroll Accounting Working Papers

Payroll accounting working papers serve as crucial documentation that supports the accuracy and completeness of payroll accounting records. They provide a systematic framework for organizing and analyzing payroll data, facilitating the efficient processing of payroll transactions and ensuring compliance with relevant regulations.

Different types of payroll accounting working papers include:

- Time records: Document employee hours worked, overtime, and absences.

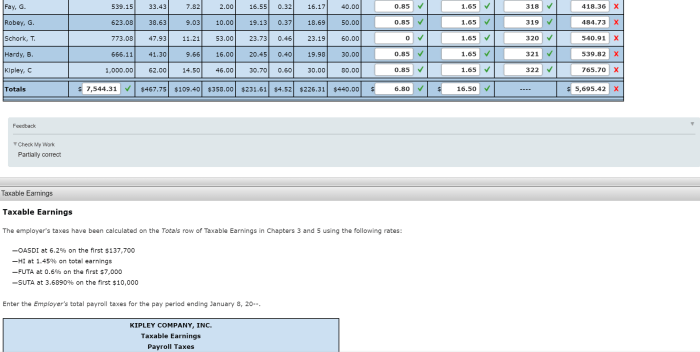

- Payroll registers: Summarize payroll transactions for each pay period, including gross pay, deductions, and net pay.

- Payroll summaries: Provide a consolidated view of payroll expenses, deductions, and withholdings for a specific period.

- Tax reports: Report payroll-related taxes, such as income tax, Social Security, and Medicare.

2. Creating Payroll Accounting Working Papers

Creating payroll accounting working papers involves the following steps:

- Gather source documents: Collect time records, employee earnings statements, and other relevant documents.

- Prepare time records: Verify and enter employee hours worked and any applicable overtime or absences.

- Calculate gross pay: Multiply employee hours by their hourly rate or use applicable salary calculations.

- Apply deductions: Subtract authorized deductions, such as taxes, insurance premiums, and retirement contributions, from gross pay.

- Calculate net pay: Determine the amount of pay remaining after deductions.

- Prepare payroll registers: Summarize payroll transactions for each employee and pay period.

- Review and approve: Ensure accuracy and completeness of working papers before finalizing payroll.

Accuracy and organization are paramount in working paper preparation, as they provide a reliable basis for payroll processing and auditing.

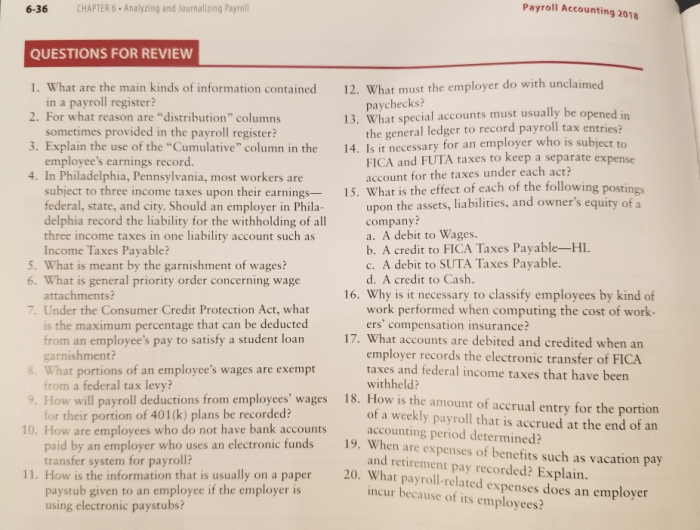

3. Analyzing Payroll Accounting Working Papers: Chapter 12 Payroll Accounting Working Papers Answers

Analyzing payroll accounting working papers involves:

- Verifying accuracy: Checking for mathematical errors, such as incorrect calculations or omissions.

- Ensuring completeness: Confirming that all relevant payroll transactions are included and properly recorded.

- Identifying common errors: Looking for inconsistencies or irregularities, such as missing or duplicate entries, incorrect tax calculations, or unauthorized deductions.

Thorough analysis ensures the reliability and integrity of payroll accounting records.

4. Using Payroll Accounting Working Papers for Audits

Payroll accounting working papers play a vital role in payroll audits, providing:

- Evidence of payroll transactions: Supporting the accuracy and completeness of payroll records.

- Basis for audit findings: Identifying potential errors or non-compliance issues.

- Documentation for auditors: Facilitating the audit process and providing a clear understanding of payroll accounting practices.

Working papers are essential for auditors to evaluate the effectiveness of internal controls and assess the reliability of payroll accounting data.

5. Best Practices for Payroll Accounting Working Papers

Best practices for maintaining and organizing payroll accounting working papers include:

- Using a standardized format: Ensuring consistency and ease of use.

- Documenting all calculations: Providing a clear audit trail and reducing the risk of errors.

- Storing working papers securely: Protecting sensitive employee and payroll data.

- Utilizing technology and software: Streamlining working paper management and enhancing efficiency.

Adhering to best practices promotes accuracy, organization, and compliance in payroll accounting working papers.

Question & Answer Hub

What is the primary purpose of payroll accounting working papers?

Payroll accounting working papers serve as a comprehensive record of the steps, calculations, and supporting documentation used in the payroll accounting process.

How do payroll accounting working papers contribute to audit efficiency?

Working papers provide a clear and organized trail of evidence that auditors can use to verify the accuracy and completeness of payroll transactions and calculations.

What are some common errors to look for when analyzing payroll accounting working papers?

Common errors include incorrect calculations, missing documentation, and inconsistencies between working papers and other payroll records.